Silicon Valley Bank's Shut Down Stokes Financial Trauma of 08' Recession

Earlier today, 3/10/2023 Silicon Valley Bank was shut down by regulators in largest US bank failure since the 2008 financial recession. According to CNBC, “The collapse of SVB, a key player in the tech and venture capital community, leaves companies and wealthy individuals largely unsure of what will happen to their money.”

While this seizure may or may not impact you directly, questions around how “safe” keeping your money in banks are at this time may arise, giving possible justification to generations old behaviors like keeping money under a mattress, in a shoe box, or tucked away in some appliance for safe keeping.

Understanding how deposit insurance works is crucial in instances like these while also taking the time to process the emotions that come with these types of announcements and the panic that may ensue.

Yes, this is serious but no time to make rash financial decisions.

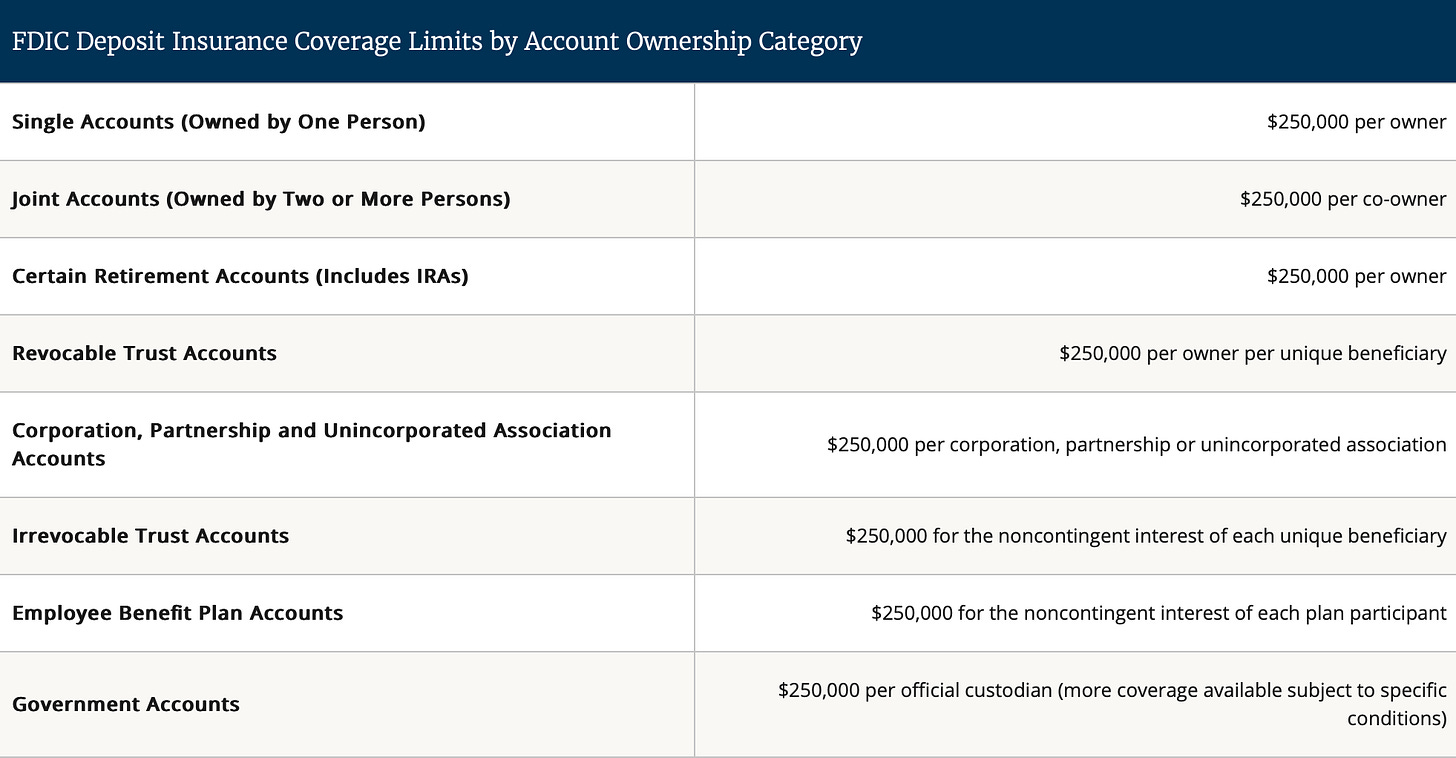

FDIC, short for Federal Deposit Insurance Corporation, insures bank deposits of up to $250,000 per account ownership type, per depositor, per bank. This covers

Checking Accounts (DDA)

Savings Accounts

Money Market Accounts

Certificate of Deposits (CD’s)

Cashier’s checks and Money Orders issued by the bank

Negotiable Order of Withdrawal (NOW) accounts

For a list of what the FDIC insurance does and doesn’t cover you can click here

See the following table from the FDIC website on the account ownership types covered:

What this means is that if you have a single account with $250,000, a joint account with $250,000, a bank IRA with $250,000, etc. that your deposit balances are covered by this insurance. Whereas if you had $500,000 in a single account only $250,000 of that money would be insured.

Invested balances are not covered by FDIC and are held in brokerage accounts outside of a traditional retail banking environment.

CNBC reports that, “According to press releases from regulators, the California Department of Financial Protection and Innovation closed SVB and named the FDIC as the receiver. The FDIC in turn has created the Deposit Insurance National Bank of Santa Clara, which now holds the insured deposits from SVB. The FDIC said in the announcement that insured depositors will have access to their deposits no later than Monday morning. SVB’s branch offices will also reopen at that time, under the control of the regulator”.

Similarly, NCUA, short for National Credit Union Administration, “insures individual accounts up to $250,000. Additionally, a member’s interest in all joint accounts combined is insured up to $250,000. The Share Insurance Fund also separately protects members’ IRA and KEOGH retirement accounts up to $250,000 and provides additional coverage for members’ trust accounts” according to their website.

So there is no need to worry about whether or not your money is safe in national banks or credit unions unless balances per account type, per custodian, are in excess of $250,000.

Processing your feelings

While news like this can be unsettling it’s important to remember to stay calm. Understanding that there is nothing you alone can do about these turn of events and controlling what it is you can do is very important. Taking time to remind yourself of your and your families personal safety and security, and focusing on being present in the moment through mindfulness exercises can quiet the anxiety that news programming and social media may agitate. Understanding where you are financially and talking through your strengths and weaknesses can put you on a path to better planning for the short and long term future.

During the 2008 crisis I was old enough to remember but young enough not to be too impacted by what was going on around me. Today, that looks different with a mortgage and other financial obligations. If you were old enough to remember and be impacted by the 08’ recession you may be feeling feelings of anxiety related to the current state of the economy. It can be helpful to recognize that while these feelings are indeed valid, your lived experience has brought you to this point— 15 years into the future, with experience, education, and resources you may not have had 15 years ago. If you, like me, were too young to be really impacted by the recession of ‘08 this can be an uncertain time for you and in both instances you may benefit from the help of a financial professional like a financial counselor, financial therapist, credit or debt counselor, etc.

Acknowledging your feelings help to neutralize them so that you can allow them to inform —not control— your behaviors.

Here’s a previous article I wrote that might help!

What do you think of the news? Are you panicked? Did you know about the FDIC and NCUA insurance amounts?

Consider joining the paid membership for exclusives and additional insightful posts.

Before I let you go, last week I also had a wonderful conversation with a creator whose content I enjoy. His name is Sohaib Albadawee. I asked him to share a few words about the work he’s doing and to provide any resources that might help someone looking to monetize their audience and here’s what he had to say:

A job gets you paid, and entrepreneurship gets you freedom. Join 5,000+ others in Growth Tribe Newsletter and receive weekly actionable tips to grow, and Monetize your one-person business. Join Growth Tribe

As a Certified Financial Education Instructor (CFEI®)and Accredited Financial Counselor (AFC®) I have the skills you need to improve your knowledge, relationship, and behaviors around money. I help you overcome financial trauma and accomplish your financial goals. Reach out with inquiries regarding 1x1 or group bundle sessions or have me speak at your organization. Rahkim@rahkimsabree.com

If you’ve enjoyed any of my posts please share and encourage others to subscribe. Also consider subscribing to the paid version as well. I’ve been adding more exclusive content for the paid subscribers that you simply won’t get here. If you’re looking to level up financially in 2023 definitely hit that button. Also let me know what things you’d want to see on the exclusive side. Expert interviews? Live Q&A? Freebies? Tools? Giveaways?

Lastly don’t forget to check out and rate the podcast wherever you listen to podcasts.

Thank you always,

Rahkim